If you’re owed a lot of money, or the situation is complicated, you’re less likely to get paid immediately. If they do, it won’t cost you any more than the initial fee, and you won’t have to go to court. Your customer might pay soon after they get your claim, to avoid getting a court order against them.

It can include any interest and compensation you’re owed. You can make a court claim for the money you’re owed (often called a ‘money claim’ or ‘small claim’). If you haven’t already talked to your customer about using mediation or other options if you’re owed more than £3,000, it’s a good idea for your letter to offer these as a way to avoid court. Ask them to include their reasons for disagreeing, giving details and attaching any relevant documents. The letter should also ask your customer to write back if they don’t agree with the letter, or they have another issue with paying. what you’ll do if they don’t pay or respond, for example make a court claim for the money.a reasonable deadline for paying or responding (at least 14 days).dated copies of any relevant documents, for example purchase orders, invoices and statements.what you’ve already done to try to get the money.how much they owe you, including any interest and compensation.the goods or services that they owe you for.business names and addresses for you and your customer.This is often known as a ‘final payment notice’ or ‘pre-action letter’. sent your customer a letter to warn them about the action you’ll take if you’re not paid – consider using a solicitor to do this.emails, letters or other records showing that you’ve tried to negotiate or use mediation or tried other alternatives to court.If you don’t, it could count against you if you go to court. Make sure that you have proof that you’ve tried to resolve the payment problem with your customer before taking legal action. You should still make sure you’ve done everything you need to in case you do end up in court. But you might not have to – sending a solicitor’s letter or making a money claim can sometimes prompt a customer to pay what they owe you, without having to go to court. Starting legal action can eventually mean taking a claim to court and getting a binding decision from a judge. The Law Society and Citizens Advice websites have advice about questions to ask before and during your appointment. It’s best to choose someone with experience in debt recovery.

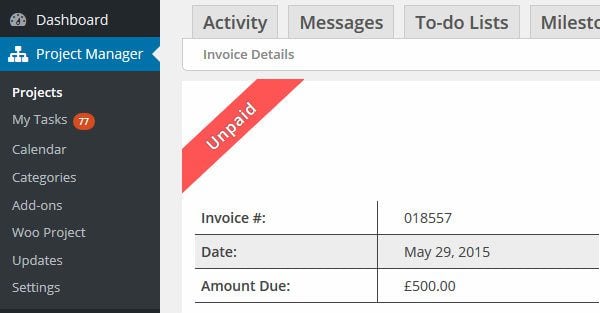

Unpaid invoices small business free#

use Lawyers for your Business to get a free 30-minute consultation in England or Wales.ask your local Citizens Advice or law centre if they have a list of legal advisers that do this.search for a solicitor or legal adviser that does this – you’ll need to contact them to ask.Most solicitors offer a short first appointment for a small fixed fee, or for free. A short appointment with a solicitor or legal adviser can give you a better idea of what legal action might work in your situation. Deciding to take legal action on an unpaid invoice As a small business owner, taking legal action against a non-paying client can be a daunting prospect, but you shouldn’t be put off you deserve to be paid for all of the work you do.

0 kommentar(er)

0 kommentar(er)